A major CNN investigation found hundreds of criminal reports tying scams to cryptocurrency ATMs — the cash-to-crypto kiosks you can find in convenience stores and gas stations — and showed that some operators, including prominent firms, profit from those transactions even as victims struggle to recover funds.

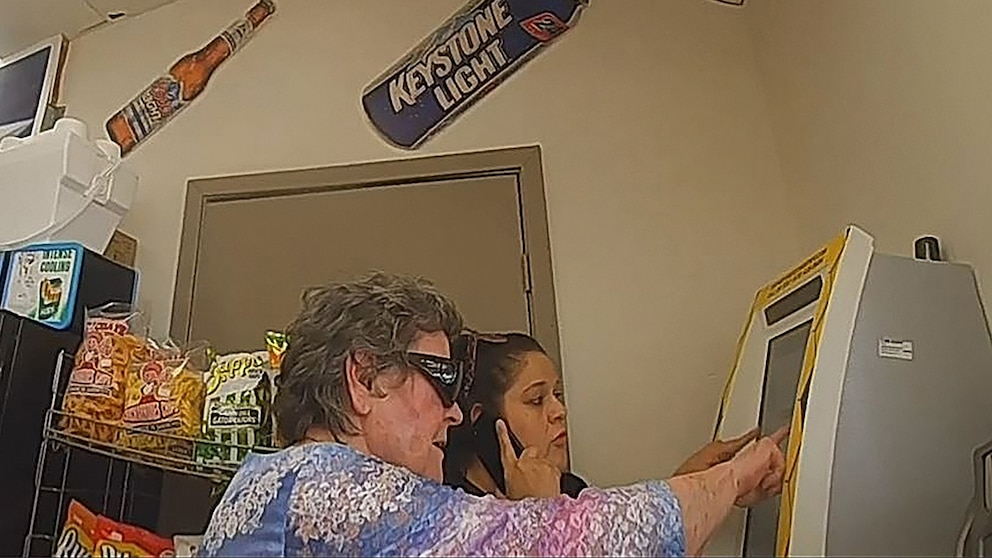

How the scam works

Scammers typically call or text a target, impersonate a bank, law-enforcement agency, or government program, and create an urgent, frightening story that pressures the victim to “pay” immediately. Instead of buying gift cards like older cons, victims are told to withdraw cash and feed it into a nearby crypto ATM. The machine converts the cash into cryptocurrency and the funds are routed internationally, often to exchanges or wallets outside U.S. jurisdiction — making recovery extremely difficult. The FBI estimates Americans lost roughly $240 million to these schemes in the first half of 2025.

Why crypto ATMs matter to scammers (and why operators profit)

Crypto ATMs are fast, cash-centric, and operate 24/7. That speed and anonymity are attractive to criminals: a victim can convert thousands of dollars into crypto in a few minutes and the money can be moved abroad. Operators make money on every transaction through fees and markups (commonly cited in reporting at ~20–30% in contested cases), so fraudulent transactions also generate direct revenue for kiosk owners — even when the deposit originated from a scam. CNN’s reporting includes episodes where law enforcement recovered cash from machines only to face legal battles with operators seeking to reclaim those funds.

What the data shows

Blockchain analytics firms and law-enforcement sources paint a complex picture. TRM Labs found that in 2023 about 1.2% of cash-to-crypto (ATM) transaction volume was illicit — roughly double the share for the broader crypto ecosystem — and that most illicit cash-to-crypto flows are tied to scams and fraud. At the same time, local prosecutors and state attorneys general investigating particular operators have alleged much higher scam shares at specific companies’ kiosks. Those two sets of findings can both be true because aggregate industry numbers mask outsized problems at particular locations or with particular operators. TRM Labs

Real examples (what reporting uncovered)

CNN’s investigation reconstructed more than 700 incidents and showed multiple scams tied to the same physical ATM locations. One widely reported episode involved law enforcement seizing cash from a machine, after which the kiosk operator contested the seizure in court — underscoring how rights and responsibilities collide when cash becomes crypto. The reporting named major operators in the U.S. market and documented interactions between police and kiosk companies over seized funds.

Consumer protection gaps and law enforcement limits

Once cash is converted to crypto, tracing and recovery become difficult for several reasons: scammers often route funds to non-U.S. exchanges or mixer services; transnational cooperation can be slow or impossible; and many victims delay reporting because of shame or embarrassment. Even when police identify the victim and locate the kiosk, legal and contractual defenses raised by some operators have sometimes prevented immediate restitution. Those obstacles explain why state legislatures and a growing number of attorneys general have focused specifically on regulating crypto kiosks. CNN Transcripts

Where states and regulators have stepped in

In response, more than a dozen states have adopted or proposed measures aimed at reducing losses via crypto ATMs: daily transaction caps, mandatory posted warnings, enhanced recordkeeping, and rapid-reporting requirements for suspicious transactions. Some operators have pushed back — hiring lobbyists and proposing model rules with weaker protections — creating a patchwork of state laws that varies widely in consumer safeguards. Meanwhile, federal oversight remains limited and contested, and political decisions about federal crypto policy shape how aggressive national enforcement can be.

Practical advice for readers

If someone calls demanding immediate payment and tells you to use a crypto ATM:

- Stop. Do not withdraw or deposit cash into a crypto ATM under pressure.

- Ask for a real phone number, call the institution’s published number, and verify independently.

- Contact a trusted family member before taking action.

- Report the incident to local police and to the FBI’s Internet Crime Complaint Center (IC3).

- If you already deposited cash at a kiosk, get the transaction receipt and contact local law enforcement immediately — but know recovery is often difficult. (For the scale of recovery challenges and examples, see CNN’s reporting.) CNN Transcripts

Why naming operators matters (and why CoinFlip was in investigators’ crosshairs)

The CNN team traced industry influence and found that executives from large kiosk operators have attended industry and government events while some companies have faced state enforcement actions. One operator explicitly named in the reporting was CoinFlip, whose leadership and lobbying activities were scrutinized as part of broader inquiries into whether kiosks’ business models expose consumers to harm and whether operators do enough to stop scams. Publicly naming operators focuses scrutiny where remedies can be targeted — on transaction controls, disclosure practices, and cooperation with law enforcement.

How this could reshape U.S. politics and policy

The rise of crypto-ATM scams sits at the intersection of consumer protection, technology policy, and political lobbying — and that makes it a potential political flashpoint for several reasons.

First, states are already moving faster than the federal government. When state legislatures enact transaction limits or mandatory reporting, those laws can quickly affect where and how kiosks operate — creating a patchwork that invites federal harmonization efforts or preemption fights. Second, the industry’s lobbying and donations to state officials (or invitations to industry-sponsored events) raise questions about regulatory capture and transparency; those questions gain traction in both state attorney-general offices and in the halls of Congress, especially when victims are retirees or other sympathetic constituencies. Third, the issue can become a wedge between political priorities: one side may emphasize technology innovation and industry self-regulation; another will push consumer protections and stricter enforcement. That tug-of-war plays out in committee hearings, budget fights for law-enforcement resources, and appointments to regulatory posts.

If evidence continues to show concentrated harm at particular operators, expect increased state enforcement and a renewed push in Congress for federal standards — particularly around transaction limits, mandatory transaction logs tied to verified identity, and expedited law-enforcement access when machines are used in alleged scams. Those developments will be shaped by the balance of power in statehouses and in Washington, the influence of industry lobbyists, and high-profile victim stories that resonate with voters.

Bottom line

Crypto ATMs are a useful payment rail for legitimate users, but their combination of cash, speed, and cross-border rails has created a high-leakage vector for scams. The recent investigative reporting puts operators like CoinFlip squarely in the public debate and fast-tracks regulatory scrutiny. Whether through smarter kiosk controls, clearer state laws, or federal action, consumers need stronger protections — and lawmakers are increasingly under pressure to deliver them.