15,965 BTC Linked to Chen Zhi’s Sanctioned Wallet Suddenly Moves On-Chain

In a surprising development, 15,965 BTC — tied to the sanctioned wallet of Chen Zhi, the controversial leader of the Prince Group — has just moved on-chain for the first time in over three years. Blockchain analysts are buzzing about this sudden activity, which suggests that despite ongoing sanctions and seizures, parts of Chen Zhi’s cryptocurrency empire remain operational.

The transaction was confirmed by multiple on-chain monitoring platforms early this morning. Analysts note that this specific batch of Bitcoin was not part of the 127,000 BTC the U.S. government recently announced seizing from Chen’s network last week, further deepening the mystery around the scope of his holdings and the resilience of his crypto infrastructure.

Who Is Chen Zhi and Why He’s Sanctioned

Chen Zhi, also known as Neak Oknha Chen Zhi, is a Cambodian businessman and the chairman of the Prince Group, a powerful conglomerate with interests spanning real estate, finance, and tourism. The U.S. Department of the Treasury sanctioned Chen in connection with human trafficking, money laundering, and large-scale fraud — allegations that painted him as the architect of one of Southeast Asia’s most sophisticated criminal financial networks.

The Treasury’s Office of Foreign Assets Control (OFAC) froze his assets and labeled dozens of his affiliated wallets as part of a coordinated international crackdown. Yet, today’s blockchain movements imply that Chen or his associates might still have access to substantial cryptocurrency reserves beyond the reach of Western authorities.

The 15,965 BTC Movement: What It Means

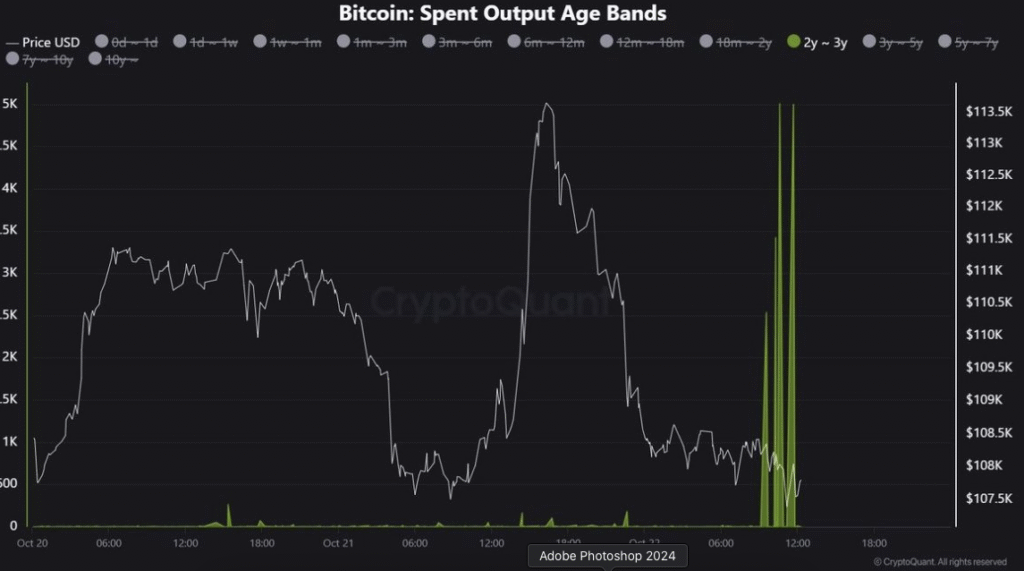

The 15,965 BTC, valued at approximately $1.1 billion USD, was moved through a series of complex wallet transactions designed to obscure its final destination. Experts believe this may be a test transfer or part of a broader laundering effort involving mixers or privacy-focused chains.

On-chain intelligence platforms such as Arkham Intelligence and Glassnode are closely monitoring the addresses involved to determine whether this movement connects to known exchanges or darknet markets. If these funds make their way to centralized exchanges, compliance departments may soon face difficult decisions about reporting and freezing the assets.

The Political Ramifications in the U.S.

This latest event could have major political implications in the United States, especially given the Biden administration’s emphasis on tightening crypto oversight and combating illicit finance. With the 2024 elections behind us and policymakers now evaluating digital asset frameworks for national security, such incidents reinforce calls from lawmakers for stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) enforcement across exchanges.

Republican leaders may use this as evidence that current regulations are ineffective, pushing for stronger international cooperation and sanctions enforcement mechanisms. Democrats, meanwhile, might leverage the story to justify advancing bills that expand the authority of agencies like the FinCEN and SEC over crypto assets.

In short, Chen Zhi’s Bitcoin movement doesn’t just highlight the persistence of transnational crime — it could reignite debate in Washington over how much control the government should have over the decentralized financial ecosystem.